Well that was a rapid (r)evolution.

Early weekday mornings, I usually subject myself to CNBC. I routinely torture myself with at least small doses of Big Media – because, it seems, I am part masochist.

Please forgive the dearth of details in the following – I was in the shower when it occurred:

Last week, CNBC guest had a Big Investor guest. Nigh all of CNBC’s guests are Big Investors – or execs of the Big Businesses in which they invest. This person – or his interlocutor – said something along the lines of “We probably don’t need regional banks anymore. We could probably do well with just 3 or 4 Big Banks.”

Whoever this was – isn’t the only person peddling this corrupt idiocy.

Bigger Banks Are a Necessary Evil

Time Is Right for a Wave of Bank Consolidation

US Regional Banks ‘Need Consolidation,’ Canyon’s Lemkin Says:

“‘We need less banks,’ alternative asset manager says Pimco….”

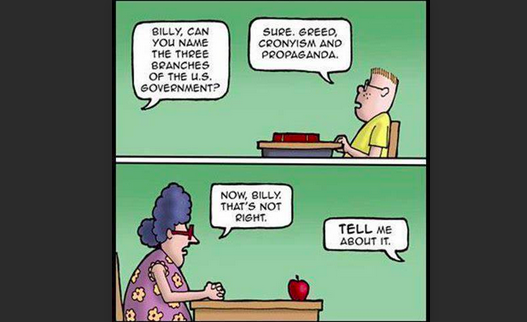

First: Big Investors – are heavily invested in the exceedingly awful status quo. They make LOTS of money in our Big Gov-Big Biz kleptocracy. The LAST thing they want is any sort of bank “reform” – that might actually result in bank reform.

Second: DC’s last bank “reform” – 2010’s Dodd-Frank – was supposed to end “too big to fail” banks. Except it was written by the Big Banks – for the Big Banks. So it murdered 1000s of small and medium-sized banks – and made the Big Banks 30% bigger.

A little over a decade later, banks of larger and larger size are sinking beneath the tidal waves of a hyperactive, corrupt Big Government – unleashed at the behest of the Big Banks.

Please note: The Federal Reserve doesn’t present very much evidence of the failure of the banks they are seizing – and then flipping to Big Bank cronies. We’re just supposed to trust them. Ummm…okay.

And we’re supposed to simply forget the cataclysmic, corrupt outcome of DC’s last bank “too big to fail” “reform.” And now just accept our 3 or 4 Big Bank crony overlords.

Small and medium-sized banks – were the ones that lent money to someone besides rich people. Big Banks – loan almost exclusively to rich people.

Big Banks Only Lending to Rich People

Big U.S. Banks Are Going All Out on Loans to the Wealthy

Banks Are Spending Billions To Make Rich People Richer

Banks Are Giving the Ultra-Rich Cheap Loans to Fund Their Lifestyle

DC Is Ensuring Only Billionaires Can Get a Loan – In the Name of ‘Helping the Little Guy’

As small bank murders have increased – the number of poor people has increased. Because there’s no money to borrow. Money to improve their standing in life – or prevent their sliding (further) down the food chain.

As always: The Wealth Gap between The Rich and everyone else – is as big or as small as government is. We have a HUGE government – and it’s getting ever huger. So the Wealth Gap continues to grow ever more cavernous.

The only chutes of Little Guy green that have thrust their way upward through the Big Gov-Big Bank desert – are the payday lenders. Who lend to even the poorest of the poor.

The Big Gov-Big Bank cabal – can not allow this to happen.

The Big Banks get whatever they want out of Washington, DC. Including the endless harassment of payday lenders.

Big Banks’ Further Market Consolidation – Further Aided by Big Government

Payday Loans: Big Gov-Big Bank Cabal Won’t Let You Leave Their Matrix

Payday Lenders: More and More, DC’s Leftists Are Siding with Big Business

The Federal Trade Commission (FTC) is incessantly shooting at payday lenders. Their website has fifty entries under “payday lender” – almost all of them actions against payday lenders.

Actions – that almost always include fines. Because of course.

The late, great Rush Limbaugh asked of cigarettes, semi-rhetorically: “If they’re so bad, why doesn’t the government just ban them?” Semi-rhetorical – because the answer is obvious: If government bans cigarettes – it can’t tax cigarettes.

The Golden Goose, and all that.

The FTC imposes all sorts of fines upon payday lenders – so they likely won’t ban payday lenders.

That’s where some corrupt legislators in DC – and around the country – enter the scene. Lawmakers up and down the government food chain – are looking to price cap payday loans.

New Map Reflects Trend Toward Capping Payday Loan Interest Rates Across the Country

Except….

Government Mandating Prices Is Just as Stupid When States and Localities Do I

As anyone with an IQ above 9 on a warm day knows:

“(P)rice caps destroy the products capped.

“‘Price Controls Cause Shortages:

“‘In a shortage, there are people willing and able to pay the controlled price of a good, but they cannot obtain it. The good is simply not available to them.

“‘Experience of the gasoline shortage of the winter of 1974 should make the concept real to everyone. The drivers of the long lines of cars all had the money that was being asked for gasoline and were willing, indeed, eager, to spend it for gasoline.

“‘Their problem was that they simply could not obtain the gasoline. They were trying to buy more gasoline than was available.’

“You want to make it harder for poor people to get loans? Cap the prices of their loans.”

Big Banks loan less and less to poor people. And what little lending they do – they do at confiscatory rates. Are any legislators anywhere doing anything about that?

Big Banks Charge Ridiculous Loan Rates – Big Gov Isn’t Looking to Murder Them

Because of course.

That would impede Big Government delivering us their 3 or 4 Big Bank crony Hellscape.

LONG gone is DC’s alleged “too big to fail” reform.

Or any pretense of its “too big to fail” reform.